X

ETF - Market Timing Service

Premium Stocks Service

DJIA Historical Charts

1929 DJIA vs. Nasdaq Crash

Buy & Hold Days

Yahoo! Econ. Calendar

StockCharts.com

Yahoo! Finance

TheStreet.com

BigCharts.com

eSignal.com

Make Us Your Home Page

Financial Server

Private Policy

Disclaimer

Link-To-Us

Feedback

(DIA, SPY, and QQQ)

This table is exclusively available to members only!

The latest timing signals are highlighted as either

"long",

"short", or

"hold"

for each index stock.

Click on the ticker symbol for stock information and chart below:

| Index Stock | Position | Open Trade date / price | Close Trade date / price | Gain/(Loss) Return | Year-To-Date Return Year "2014" | Cumulative Return "2000 - 2014" |

|---|---|---|---|---|---|---|

DIA Chart |

Cash | 11/28/14 178.35 | Open | Open | Open | Open |

| Long | 08/04/14 164.40 | 11/28/14 178.35 | 8.5% | 14.1% | 298.2% | |

| Short | 07/31/14 166.30 | 08/04/14 164.40 | 1.1% | 5.6% | 289.7% | |

SPY Chart |

Cash | 11/28/14 207.40 | Open | Open | Open | Open |

| Long | 08/04/14 192.50 | 11/28/14 207.40 | 7.7% | 16.8% | 281.8% | |

| Short | 07/31/14 194.25 | 08/04/14 192.50 | 0.9% | 9.1% | 274.1% | |

QQQ Chart |

Cash | 11/28/14 106.10 | Open | Open | Open | Open |

| Long | 08/04/14 94.85 | 11/28/14 106.10 | 11.9% | 23.9% | 401.3% | |

| Short | 07/31/14 95.50 | 08/04/14 94.85 | 0.7% | 12.0% | 389.4% |

Overall Short-Term Probability Indicator: December 04, 2014

StockMarketTiming.com's Weekly Newsletter

December 04, 2014

MARKET OVERVIEW

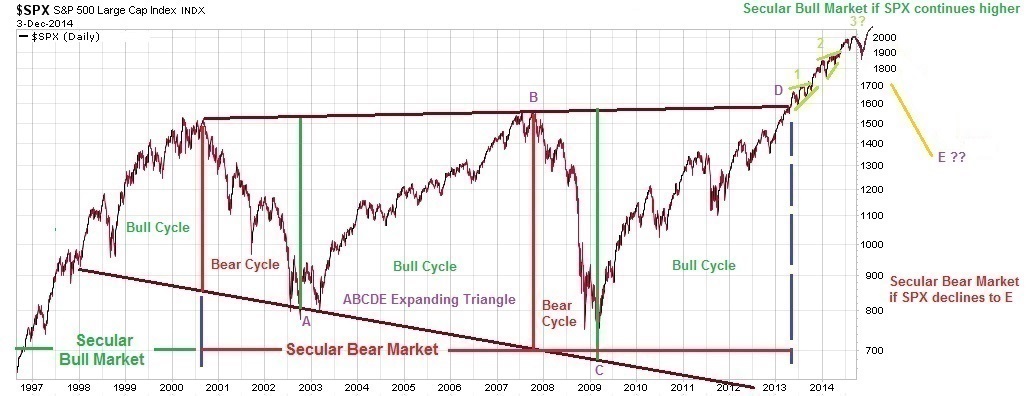

- Bear cycle -- Aug '00 to Sept '02, the S&P declined 46%

- Bull cycle -- Sept '02 to Oct '07, the S&P increased 90%

- Bear cycle -- Oct '07 to Mar '09, the S&P declined 53%

- Bull cycle -- Mar 06, 2009 (intraday low of 666.79) to November 28, 2014 (intraday high of 2075.76), the S&P has increased about +211%

StockMarketTiming.com's ETF - Market Timing Service released a hold cash trade alert signal change for DIA, SPY and QQQ on November 28, 2014. Our technical interpretation of the S&P 500 index continues to be in sync with the dynamics of the market.

Overall Comment: We are short-term neutral, intermediate-term neutral to bearish, and long-term undecided.

Short-Term Outlook:

The S&P 500 Index ($SPX) continues to trade within a long-term uptrending channel (darkblue lines) that began in 2012. Last week the S&P broke above the upper boundary of a broad expanding wedge formation (orange lines) that began in June 2014. Since the breakout, the index is declining back to the upper boundary of the wedge. Will this line act as support? There are three possible scenarios:

1. Broad expanding wedge (bearish) - this would signal an end to the bull cycle if a true top has been made, and the index starts to decline below the lower boundary (darkblue line) of the uptrending channel (~1900) and lows of October (~1825).

2. Broad expanding wedge (bullish) - the index could break above the upper trendline (orange line) of the wedge (~2045) and proceed to the upper channel line (~3000), which is another 4-5% higher than current prices.

3. Inverted head & shoulders formation (short-term bearish, and long-term bullish) - we could see a 3-4% pullback to the 50-day moving average (below the upper boundary of the wedge), which provides support. Then, the index turns around and breaks out above the neckline. The left shoulder was made in August, the head in October, and the potential small pullback now in late-Nov/early-Dec, followed by a surge higher and above the neckline (upslanting line connecting the highs of July, Sept and Nov).

Key indicators in the lower window are mixed. The RSI (relative strength index) has broke above the downtrending tops of June/July and September, and has reached an overbought condition. This overbought reading was sighted last week, which is why we changed signals to a short term cash position. The MACD (moving average convergence/divergence) had a strong bullish pattern, though it is has now crossed into bearish territory. Seasonality may play a large role in the short-term future of the S&P, which is presented in the next paragraph.

S&P 500 Large Cap Index ($SPX)

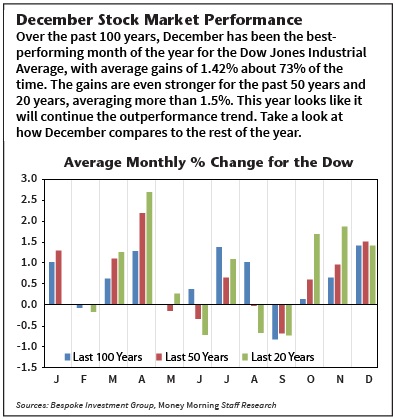

Over the last 100 years, December stock market performance has been the Dow's best. The blue-chip benchmark has averaged a 1.42% gain in December over the last century, with positive returns 73% of the time. What's more, "no other month comes close in terms of the consistency of higher prices over the long term," according to Bespoke Investment Group.

Over the last 50 and 20 years, the 30-stock index has averaged solid gains of more than 1.5% in December. Over the last half-century, December has been the second-best month behind April, while it's been the fourth-best month over the last 20 years, data from Bespoke shows.

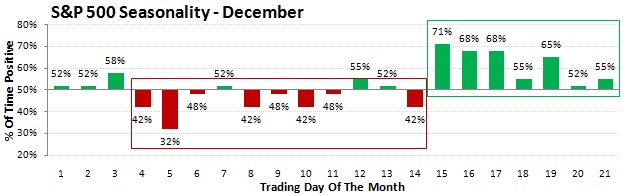

The December seasonality chart shows that the month's big strength comes around Christmas and into New Years, but prior to that there is only one day of the month (trading day #3) that is up more than 55% of the time. So if there is going to be a pullback it may very well come in the first two or three weeks in December.

Intermediate-Term Outlook:

The Dow Theory buy signal is still active since the Dow Industrials continues to trade above its September peak at a new record high, even after the recent pullback. This confirms the previous upside breakout by the Dow Transports a couple of weeks ago. According to Dow Theory, the upside breakout in both averages confirms that the bull market in stocks in alive and well.

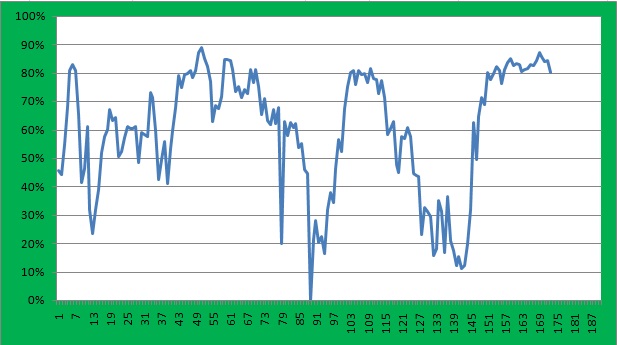

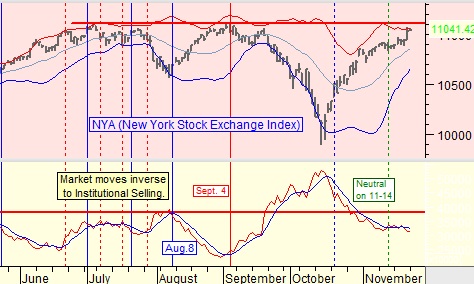

The S&P 500 had a Positive RSI Level last Friday, but it went from 87% to 80.2% of the stocks having a positive RSI level. Food for though -- 87% of the S&P 500 had a 30 day Relative Strength level above 50 on November 21st, and the number dropped to 80.2% last Friday. (Above 50 on a Standard RSI is positive.) This is occurring just when the NYA Index is close to having a triple top test. A test that tries to break above the previous double top resistance level.

You have to wonder just how 80 out of every 100 of the S&P companies can be showing a positive RSI level in this economy? Today, we posted a chart showing the levels during the past 173 trading days. Question: Based on the past 173 days, how much further do you think the S&P can go now?

Normally trouble does not come into the market until after Institutional Investors has finished selling. As shown in the lower portion of the chart below, Institutional Selling may have been been completed. The triple top of the NYA index (upper chart) may now begin to pull back from current levels.

Long-Term Outlook:

Focus on the green areas of the chart below. These areas mark the best times in the business cycle where traders and investors are in desperate need of help and start subscribing to multiple paid financial newsletter services. The strongest times for business took place during 2002-2003, and again in 2008-2010. This is when investors not only lost most of their wealth, but also their faith in how they invest, who they invest with, and the stock market as a whole. These areas are highlighted in green. Notice they are seven years apart.

Did you notice anything else? The red areas marked on the chart are market tops. They are also seven years apart.

Those of you who follow me know that I do not pick market tops or bottoms. Rather I focus on identifying trends and cycles in the market and only trade and invest with the active confirmed trend. Take a look at the chart below for a clear visual of seven-year cycle highs and lows at play.

While I do not invest based on this major seven-year cycle, I do actively trade a smaller market cycle that provides roughly 20 trades a year. This strategy allows me to profit during these major bull and bear cycles.

The reason I do not invest in the seven-year cycle is because the market can still have 30+% price swings within bull and bear market cycles and that type of volatility is beyond what I am comfortable with.

As discussed in previous newsletters, the S&P was forming an ABCDE Expanding Triangle. Many technicians identified this structure as a major "triple top" with Point D placed at about 1600. However, the S&P clearly broke above this level in early-2013.

After the breakout, the index formed three wedges. The first two are converging wedges (each breaking to higher prices), and the third is an expanding wedge. This pattern, also known as an "ending diagonal" normallt forms at a major top or at the end of a cycle - for this case, a bullish cycle. This is additional evidence that supports the hypothesis of the bullish cycle (that began in March 2009) is in the process of ending.

Two major possibilities: 1.) If SPX continues to make new highs (with or without volatility), then we are in a secular bull market. 2.) If SPX starts to decline considerably and back below the upper boundary of the ABCDE expanding triangle, then the market is still in a secular bear market. We do not want to second guess which way the market will trade, we are just presenting the possibilities.

S&P 500 Large Cap Index ($SPX), Eighteen-Year Chart

As the chart now stands, Waves A, B, C and D have gained or lost more than 45% for each cycle (see table below). That is four substantial moves in the last 10 years.

Secular Bear Market -- Year 2000 to the present:

Historical View of the Dow Jones Industrial Average 1900- present (log scale, monthly):

There are three issues worth noting:

1. The long 10-20 year secular bear zones all have many cyclical bull and bear markets, which make little in the way of net progress. After 15 years, each secular bear is essentially unchanged.

2. Due to the roller coaster ride, investors who invest based on the buy-and-hold strategy naturally become psychologically exhausted, though there are many opportunities to trade during the many up and down trends.

3. Within each secular bear zone, a major bottom seems to occur about halfway through the zone (dotted oval area). Regarding the current secular bear market, this implies that the March 2009 lows will not be revisited. If we look at the current Bear versus the ’66-’82 (with lows like ’73-’74), this suggests that 7500-8500 on the Dow will be revisited, and 800-900 on the SPX is possible. It also suggests that the next secular bull may not begin until around 2016-18.

Dow Jones Industrial Average, 1900- Present Chart

A Bullish Forecast?:

Now that the Dow (and S&P) have exceeded their 2007 highs, market technicians and pundits are assuming we are in a new secular bull market. However, look at the dashed box (chart above) for the first major secular bear market of the 1900's. Notice the first three major tops (~1906, 1910, and 1917) were all about the same height. After the major decline in the center (dashed circled area at ~1915) and the top in 1917, there was a new top in 1920 that broke out to new highs and pushed the upper boundary to where we see it today. After that top was formed, the market declined about 40% over the next two years, reaching a bottom around 1922.

The above scenario makes a lot of sense based on the trading history of the Dow since year 2000. A closer look at the Dow Industrials (chart above) over the last twenty years is shown below. As of now, the Dow has exceeded its highs of 2007, which replicates the breakout of 1919-1920. Connecting the tops of 2000 with 2007, projects to a Dow level of ~16000 to 16500, which is where the index is trading today.

The recent breakout of the Dow will move the current upper boundary higher of the most recent secular bear zone on the 112 year historical chart (above chart), much like the first zone in the early 1900s. The current price shows the market's uptrend may be very close to completion. One interpretation is that the bull cycle that began in early 2009 is nearing an end, and the market is getting set to begin the next bear cycle. Once a final top is in place, the market could undergo a very serious (massive) correction, all the way back to around 7500-8000. Applying this scenario to 20-year SPX chart, suggests the index could potentially collapse to around 850.

The entire structure for the Dow Jones Industrials (shown below) is either identified as an expanding wedge or a broadening top, since the formation is making higher highs and lower lows. For expanding wedges, they can either break higher or lower. Whereas for broadening tops, they normally have bearish implications.

The bull cycle for the Dow is still alive. With the latest development, the bull cycle that began in Mar '09 seemed to have ended recently when the Dow broke below the lower uptrending support line of the bull cycle (orange line). However, the Dow regained momentum to the upside and broke right back above the supporting bull cycle orange line and if you look closly, it is starting to break above the long-term overhead resistance line (green line) that connects the highs of 2000 and 2007. The market can still go higher, but it is important to remember that institutional investors (which control the long-term effects on the market) have been selling since mid-October.

Dow Jones Industrial Average, 20 Year Chart

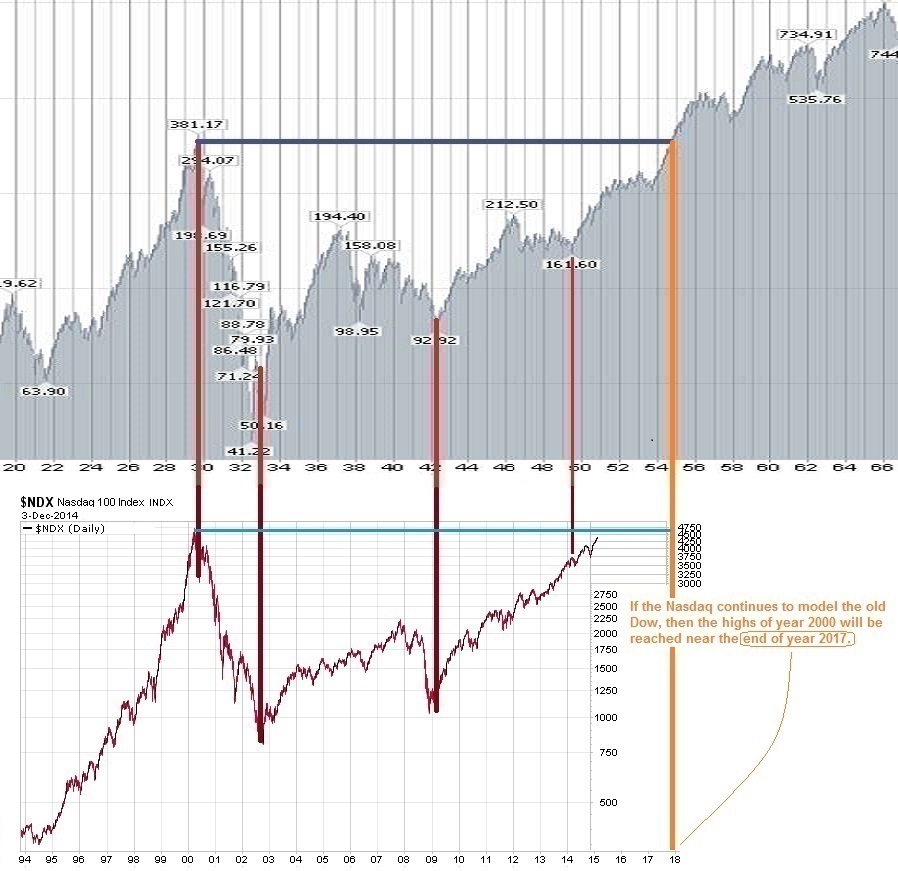

Comparison of the Dow Jones Industrial Average (1920-1966) and Nasdaq (1994-Present):

In technical analysis, charts can be interpreted many ways. So to be fair, we will present two charts that will support the case for a secular bull market. As shown below, we have plotted the Dow Jones Industrial Average for the years 1919-1966. Below the Dow is a best fit chart of the current Nasdaq from 1996-present. Positioning the 1929 high of the Dow with the 2000 high for the Nasdaq, and stretching the Nasdaq so that significant lows of the Nasdaq fit the Dow, it is logical to think the Nasdaq will continue higher from current levels -- meaning the market is now in a secular bull market, not in a secular bear market.

Dow Jones Industrial Average (1920-1966) and Nasdaq (1994-Present) Chart

TECHNICAL ANALYSIS OF THE ETFs

SPDR DJ Industrial Average ETF Trust (NYSE: DIA)

Our short-term view of DIA is "neutral." DIA continues to trade above the top boundary of the expanding wedge formation (right side, top orange line) that began in July '14. Two weeks ago we wrote, "A break above this line increases the possibility that DIA can potentially trade all the way to the upper boundary of the long-term uptrending channel (upper darkblue line)."

In the lower window, the RSI has reached an overbought condition, while the MACD has crossed into bearish territory. These key indicators suggest the upside potential may be limited. We are now in a hold cash position. However, based on seasonality as presented in the "Short-Term Outlook" section of this newsletter, we will more than likely switch our position in the days ahead to a Long Buy to prepare ourselves for a Christmas rally.

SPDR S&P 500 ETF Trust (NYSE: SPY)

Our short-term view of SPY is "neutral." The recent trading activity of SPY is almost identical to DIA. SPY has broke above the expanding wedge formation, yet has 'for the most part' reached the upper long-term channel boundary.

In the lower window, the RSI broke above the upper boundary of the downtrending channel and is in overbought territory. As stated a month ago, "A break above this line (in the lower window) would suggest SPY could trade higher. If the ETF breaks higher, then the next level of resistance is the upper boundary of the long-term upward trending channel." Now that the upper boundary has been reached, we are in a cash position. However, we will be watching the market closely in the day ahead and prepare ourselves for a typical seasonal Christmas rally.

PowerShares QQQ Trust, Series 1 (NasdaqGM: QQQ)

Our short-term view of QQQ is "neutral." QQQ has slightly broke above the upper boundary of its uptrending long-term channel (upper darkblue line).

In the lower window, RSI is coming out of an overbought condition after breaking above the upper boundary of the downtrending channel. Three weeks ago we wrote, "A break above this boundary suggests we remain bullish. However, if the RSI rolls over with the stock price, then it is probably best to change our signal status to a cash or short sell position." This was the correct interpretation, as the stock price is starting to somewhat decline.

As shown in the more detailed chart below, the ETF reached the upper boundary of the expanding wedge formation. Since this upper boundary was reached, we pulled the trigger and got our members in a cash position prior to the breakdown in stock price.

SMT's PREMIUM STOCKS SERVICE

Many of our members are signing up to SMT's very lucrative Premium Stocks service. This service provides one new stock pick each Monday with complete chart analysis and commentary. Our success can be seen by the increase in memberships to this service due to our outstanding track record:

Performance from 2002-2013:

Since the inception of our service (Sept. 2002) to the end of 2013, our results have been outstanding! We have averaged +26.0%/month (highest price achieved within two months after the release of each stock pick) with an accuracy of +80.6%! For 2014, our methods continue to find many explosive technical set-ups.

Our gain/(loss), year-to-date, and cumulative returns are the summation of individual percentage gains and losses at the end of a closed position related to a "fixed" amount of capital (meaning they are non-compounded).

Results are based on the price when each new signal was produced. Broker commissions and SEC fees have been omitted for simplicity.

Disclaimer:

Copyright © 2000 - 2015 StockMarketTiming.com. All rights reserved. The SMT Weekly Newsletter may not be redistributed without permission. In using any portion of StockMarketTiming.com, you agree to the Terms and Conditions governing the use of the service as described in this disclaimer. Our disclaimers, policies and terms are subject to change without notice.

Stockmarkettiming.com is owned and published by Robert W. Dillon, Ph.D. Robert Dillon is not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

StockMarketTiming.com does not guarantee the accuracy or completeness of the information on this website. StockMarketTiming.com does not assume any liability for any loss that may result from reliance on any information or opinions contained on this website. Such information and opinions are subject to change without notice and are for general information only.

The financial markets are risky. Investing is risky. StockMarketTiming.com’s commentaries and index analysis represent his own opinions and should not be relied upon for purposes of effecting securities transactions or other investing strategies, nor should they be construed as an offer or solicitation of an offer to sell or buy any security. You should not interpret Dr. Dillon’s opinions as constituting investment advice. Past performance is no guarantee of future results. There is no guarantee that future results will be profitable.

StockMarketTiming.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. The risk of loss in trading exchange traded funds or any other broad market indexes can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold StockMarketTiming.com liable for trading losses, lost profits or other damages resulting from your use of information on StockMarketTiming.com in any form, and you agree to indemnify and hold StockMarketTiming.com harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement.

Anyone (investors, market professionals, money mangers, individual investors, etc..) that uses the trade signals of StockMarketTiming.com during their membership and anytime after ending the service, you agree not to hold StockMarketTiming.com liable for trading losses, lost profits or other damages resulting from your use of information on StockMarketTiming.com in any form, and you agree to indemnify and hold StockMarketTiming.com harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This includes partnerships or any agreements with companies or firms who provide assets under management or money management in any form for their clients and investors.

The information we provide to you is only for your personal use and contains privileged and/or confidential information intended only for the use of the addressee. Information and contents of the website or any materials we provide to you may not be published, broadcast, rewritten, photocopied or otherwise distributed in any manner without prior written consent from StockMarketTiming.com. It is a violation of federal copyright law to reproduce or distribute all or part of this publication or its contents. The Copyright Act imposes liability of up to $150,000 per issue for such infringement. Copyright © 2000 - 2015, StockMarketTiming.com, LLC. All rights reserved.

Copyright © 2000 - 2015 StockMarketTiming.com, LLC. All rights reserved.